Don’t Let a Disaster Keep the Lights Off Forever

In the fall of 2019, wildfires fueled by high winds erupted in parts of Northern and Southern California, threatening structures in multiple communities. Wildfires have long been a concern in this sunny and dry state, but in a recent twist, millions more residents and businesses were impacted when public utilities cut off power to help prevent downed power lines from sparking fires.1

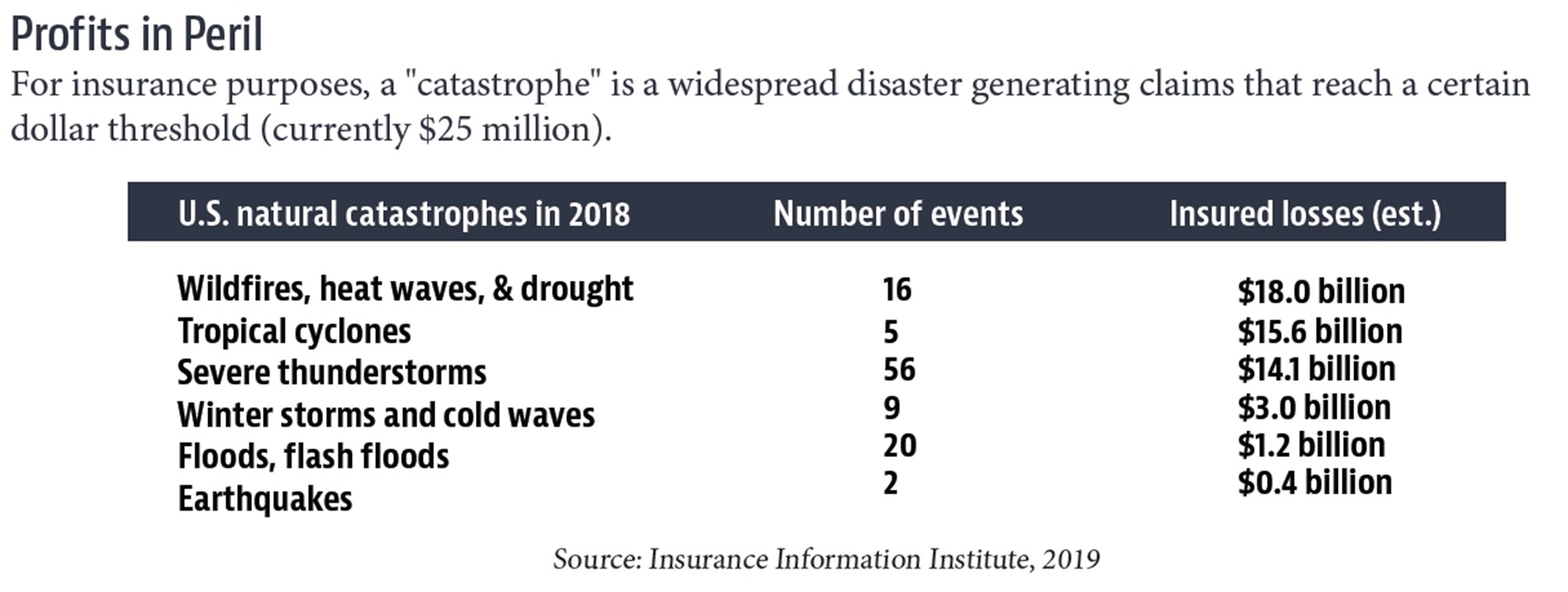

Small businesses can be hit especially hard when extreme weather or other unforeseen events result in major damage and/or force temporary closures. In fact, nearly 40% of small businesses never reopen following a disaster.2

Check Your Coverage

A business owners policy (BOP) is a package that typically combines property insurance, business interruption insurance, and liability protection (up to policy limits). Property insurance helps protect a company’s buildings, equipment, and contents against a specific list of covered perils.

Business interruption insurance helps cover lost income and operating expenses that may continue while a business is closed because of a disaster. It also helps cover relocation and advertising costs so a business can operate from a temporary site. This coverage generally kicks in after a 48- to 72-hour waiting period under three sets of circumstances:

- There is physical damage to the premises that forces your business to close.

- There is physical damage to other properties (caused by a covered peril) that prevents customers and employees from reaching your location.

- Your property is inaccessible because the government shut down the area due to widespread damage caused by a covered peril.

Be Aware of Exclusions

A business that is forced to shut down due to a power outage may not be covered, unless an optional endorsement (or rider) for “off-premises service interruption” is purchased at an additional cost. Earthquakes are also typically excluded from standard BOPs, as is flood damage. However, a separate flood policy may be purchased from the government’s National Flood Insurance Program or some private insurers.

Be Ready to Recover

Insurers will use your financial records to compare the income generated by the business before and after the disaster, so good documentation may speed up the claims process. Make sure to keep an accurate business inventory and take photos of the premises and all your business property. Store these and other financial records online so they can be accessed from a temporary location, if needed.

1) The New York Times, October 31, 2019

2) Federal Emergency Management Agency, 2019